Immigration policies have taken center stage leading up to November’s Presidential election, and likely will be discussed by Arkansas legislators as we approach the 2025 Regular Session. But often the debate over immigration is driven by emotion, not data. A new in-depth national study from the Institute on Taxation and Economic Policy (ITEP) aims to help change that by quantifying how much undocumented immigrants pay in taxes, both nationally and in each state.

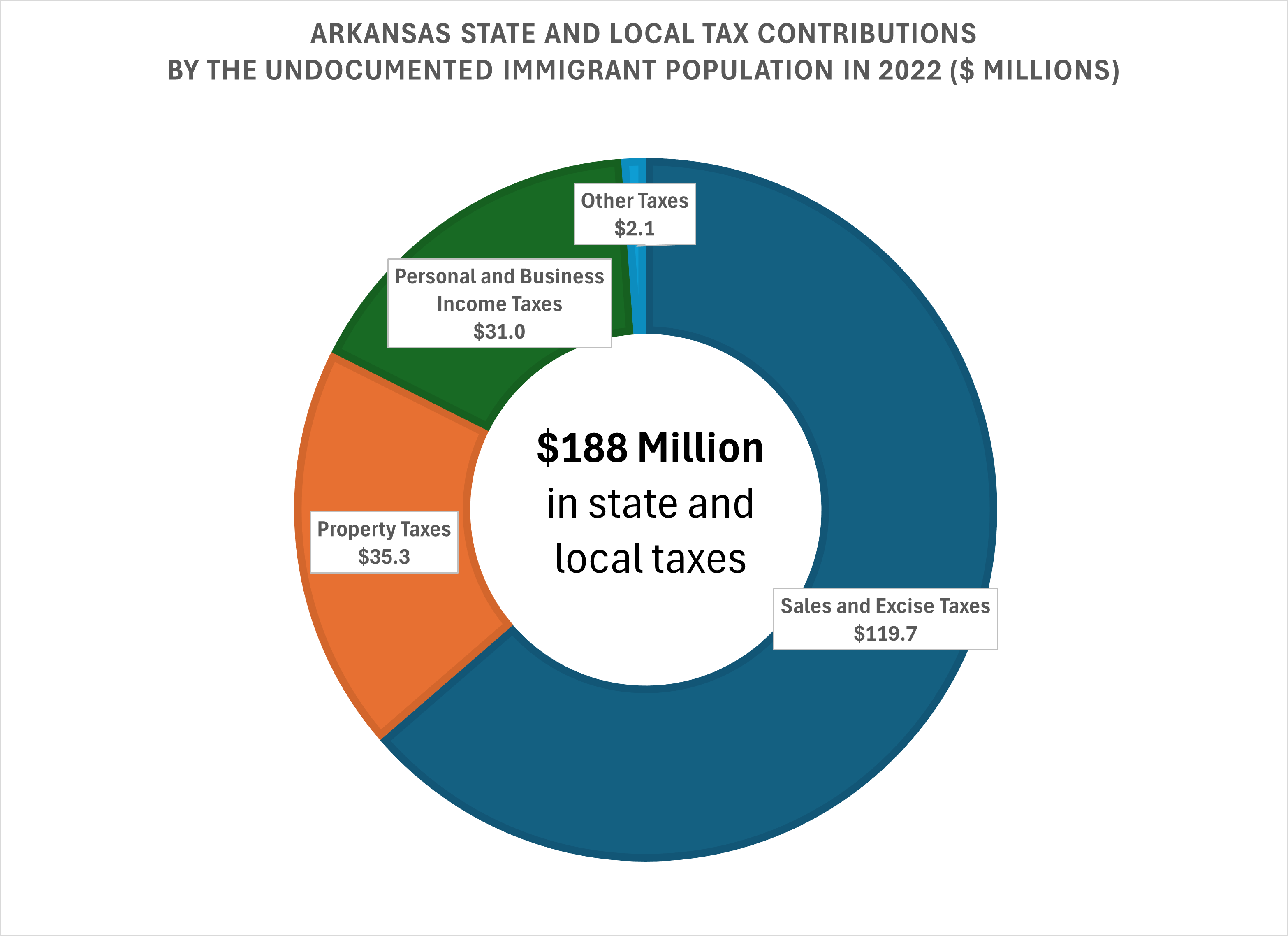

Here in Arkansas, undocumented immigrants contributed $188 million in state and local taxes in 2022, a number that would rise to $223 million if these taxpayers were granted work authorization, according to the study. In the state, undocumented immigrants pay higher state and local tax rates than the top 1% of households living here. Further, 64% of the tax contributions are through sales and excise taxes, while 19% are through property taxes, and 16% are through personal or business income taxes.

Key National Findings of the ITEP Report:

- Nationally, undocumented immigrants contributed $96.7 billion in federal, state, and local taxes in 2022. Of this, $37.3 billion went to state and local governments.

- For every 1 million undocumented immigrants who reside in the country, public services receive $8.9 billion in additional tax revenue.

- Providing access to work authorization to all current undocumented immigrants in the United States would increase their tax contributions by $40.2 billion per year, to $136.9 billion.

- More than a third of the tax dollars paid by undocumented immigrants are toward payroll taxes dedicated to funding programs — like Social Security and Medicare — that these workers are barred from accessing.

- Similarly, income tax payments by undocumented immigrants are affected by laws that require them to pay more than otherwise similarly situated U.S. citizens; as one example, they are often barred from receiving meaningful tax credits like the Child Tax Credit or Earned Income Tax Credit.

- In total, the tax contribution of undocumented immigrants amounted to 26.1% of their incomes in 2022. This figure is close to the 26.4 % rate facing the median income group of the overall U.S. population.

In the United States, undocumented immigrants are diverse. While most are from the Americas, almost a quarter are from Asia, Africa, Europe, and the Pacific Islands. Just over 4 in 10 are from Mexico.

Close to half of undocumented immigrant adults are married. Compared to U.S. citizens, undocumented immigrants are more likely to head households with children. Most undocumented immigrants are members of families that have mixed legal status. A total of 12 million U.S. citizens, including 6 million citizen children, live in households with mixed legal status.

Nearly all income received by undocumented immigrants comes from wages (86%) and self-employment income (11%). The labor force participation rate among undocumented immigrants is higher than in the native-born population. Undocumented immigrants make up 4.7% of the workforce despite only being 3.4% of the overall population.

Most undocumented immigrant adults have lived in the United States for 16 years or more. While the undocumented population is more geographically dispersed than in prior years, a large share of this population resides in a just a few states. Over half of the undocumented population lives in California, Texas, Florida, and New York.