The Arkansas General Assembly quickly convened in a special session the week of June 17 to vote on the Arkansas Game and Fish Commission budget, another round of tax cuts, and their stances on proposed ballot measures. At Arkansas Advocates for Children and Families, our focus was on the tax cut debate and its impact on the children of our state.

Tax Cuts

The Legislature passed, and the Governor signed, two tax cut laws that, according to our partners at the Institute on Taxation and Economic Policy (ITEP), will cost our state budget at least $450 million every year. Once again, Arkansas Advocates and our partners were at the Capitol and in our communities advocating against another round of income tax cuts. We opposed the tax cuts because they increase the lopsidedness of our tax system and because they take away funding that could be going towards critical programs.

The tax cut package had three components:

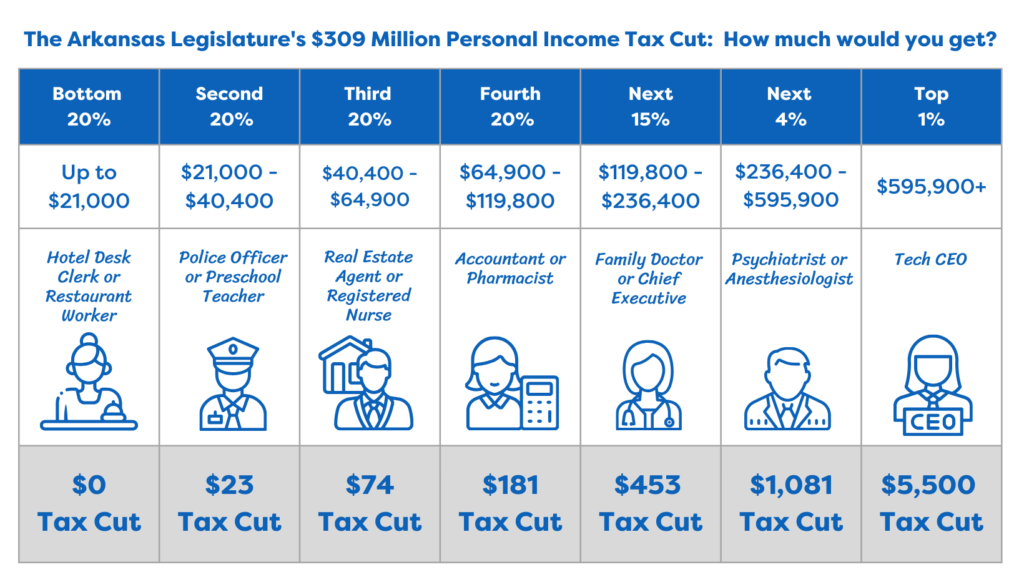

A reduction of the top personal income tax rate from 4.4% to 3.9%: While tax policies like the Child Tax Credit (CTC) are geared to providing the biggest benefit to the families who need it most, income tax cuts are the opposite. Most of the benefit goes towards those with the highest incomes. See the illustration below to see how much you will be getting. For a CTC, the chart would essentially be reversed, with the lowest income households receiving more than the wealthiest. Already in Arkansas, the lowest income people pay more than twice the percentage of their income towards taxes than the wealthiest. Each time we cut income taxes, that gap widens even more.

A reduction of the top corporate income tax rate from 4.8% to 4.3%: The biggest news from ITEP’s analysis of the corporate income tax cut is that nearly 95% of the corporate tax cut will flow out of the state of Arkansas, benefiting corporations registered elsewhere and their shareholders . Very little will be going to businesses registered here in the state.

An increase in the homestead credit from $425 to $500: The tax credit will go to homeowners who apply for the credit. No tax policies aimed at renters were considered this session.

Read more about how the tax cuts break down in our blog post here.

One other important point about the tax cuts: With the passage of this tax cut package, Arkansas has reduced state revenue by more than $2 billion every year when combined with tax cuts over the last decade. Those dollars could have been invested to improve the lives of children and families in our state. Arkansas ranks 45th in the nation for child well-being, according to the 2024 KIDS COUNT® Data Book. It is clear that investments need to be made. Read AACF Executive Director Keesa Smith-Brantley’s testimony against the tax cuts here.

Ballot Measure Opposition

Surprising some, the Legislature passed a resolution opposing the Arkansas Abortion Amendment, the citizen-initiated constitutional amendment proposal put forward by Arkansans for Limited Government. A committee also recommended that the House pass a resolution opposing the Arkansas Educational Rights Amendment of 2024 proposed by For AR Kids. But the House did not take up that resolution before adjourning the special session. Supporters of the amendments are calling the resolutions undemocratic.

Thank you!

Thank you to everyone who advocated during the special session against the tax cut proposals. We appreciate your letters to the editor, emails to legislators, and sharing information online. Though the tax cuts passed, the adverse impact of the cuts would not have received the attention it did without your advocacy. Step by step, we are making a difference!